India Tax Payers who missed to file tax for previous financial year have reasons to cheer 🙂

They have one more week to file their taxes.

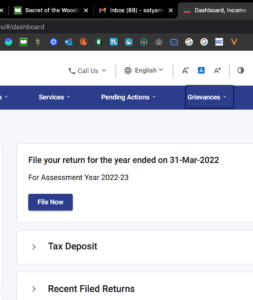

See the notification from the Income Tax department

Image Source: The Times of India, Bangalore edition 25th March 2023.

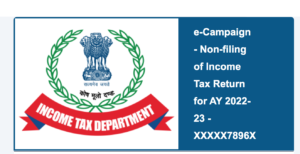

If you didn’t file income tax for the previous financial year (Financial Year FY-21-22, which is same as Assessment Year AY 22-23) , then you might have got Notice email from the IT Department with subject line

e-Campaign – Non-filing of Income Tax Return for AY 2022-23

Basically, the header information along with the image above had the below information:

“e-Campaign – Non-filing of Income Tax Return for AY 2022-23 – XXXXX9394Z

DIN: INSIGHT/CMP/02/2022-23/123456789XXXXX

Date: 23-12-2022

Assessment Year: 2022-23

Financial Year: 2021-22

#FacelessAssessment

#FacelessIncomeTax”

In the body of the email, they listed down all important transaction done in your bank (Note that the bank have a mandate to provide all the transactions)

|

|||

| The Income Tax Department has received information on financial transactions/activities relating to XXXXX9394Z for Financial Year 2021-22. However, as per records available, you do not appear to have filed Income Tax Return for Assessment Year 2022-23 (relating to FY 2021-22). Some significant information available with the Income Tax Department includes the following: |

|||

|

|||

|

|||

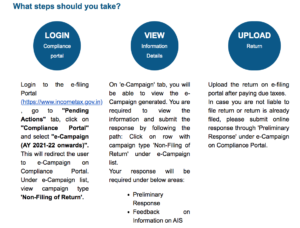

The mail guided the user to take the following actions as per screen below:

The steps to action were listed

|

|||

|

|||

|

|||

|

|||

|

|||

|

|||

The Following details were mentioned in the footer section

What is the last date for filing Income tax return?

The last date for filing Income tax return for Assessment Year 2022-23 (relating to FY 2021-22) is 31st December 2022 (Update 25th March 2023: It is reopened till 31st March 2023. See first image from Times of India)

What happens if you do not file return or submit response?

If you do not file return by due date or submit response on information, proceedings under the Income Tax Act, 1961, may be initiated to determine your income and tax liability.

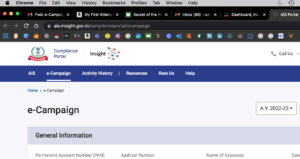

Note: If you received similar email as above, you should have responded to the above through the AIS portal

Ideally you should have responded to the above.

Case 1: If you were not eligible to file tax in FY 21-22, but you had some transactions in FY 22-23 which was reported by AIS, you can respond by saying that you are not eligible to file Income Tax for FY 21-22. The above user had never filed tax earlier. The user’s income crossed the threshold for the first time in FY 22-23 but still the user was worried by getting this email in December 2022. The user responded by saying he/she was not eligible to file tax in FY 21-22.

Case 2: If you fall under the tax bracket in FY 21-22 and missed to file Income tax, the logon to the portal. From today (25th March 2023, you can see the button to file tax. Click on “File Now”)

You may have to pay 25% of Tax and interest. Do NOT delay tax filing. Do it now to stay compliant.

If you need professional CA service, you can contact us on i2Write2020@gmail.com

We also help in Corporate tax filing. Our service of startup Company closure was mentioned in a chapter in this book on startup https://amzn.to/3jW2Mqf